Maturity value formula

Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook. V is the maturity value P is the original principal amount and n is the number of compounding intervals from.

Yield To Maturity Approximate Formula With Calculator

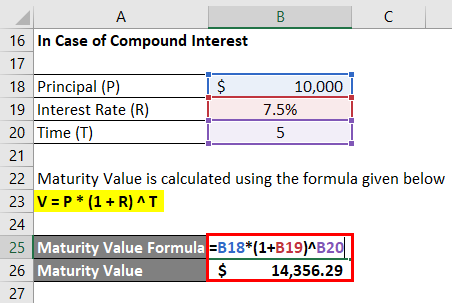

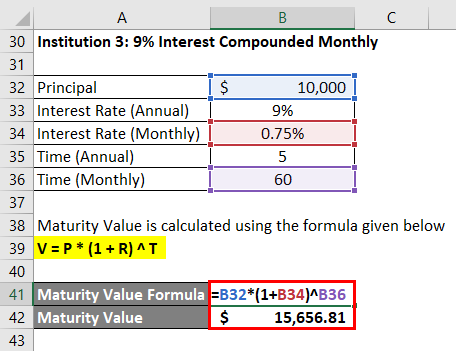

Suppose we are given the following data.

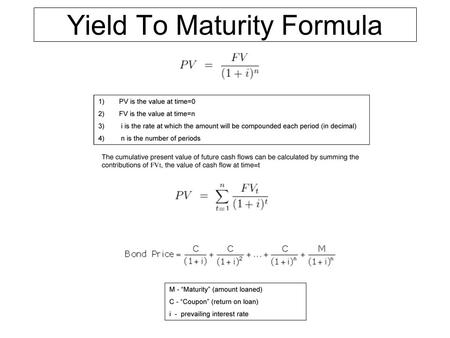

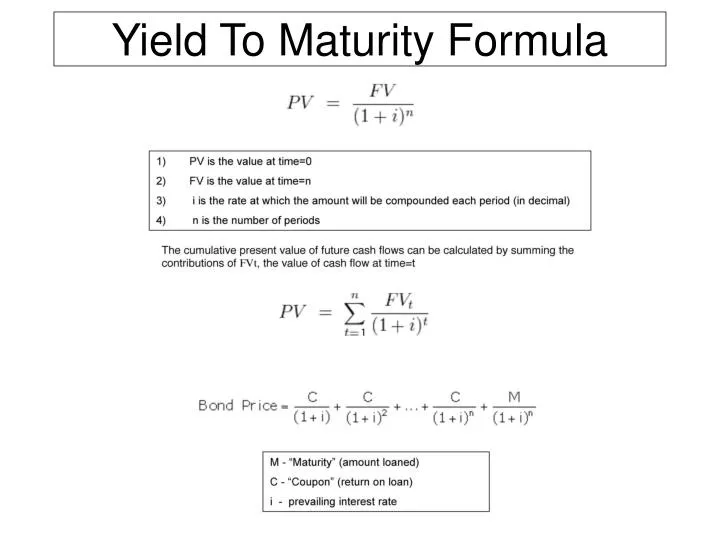

. The coupon rate for the bond is 15 and the bond will reach maturity in 7 years. Yield to Maturity YTM Formula. The yield to maturity YTM refers to the rate of interest used to discount future cash flows.

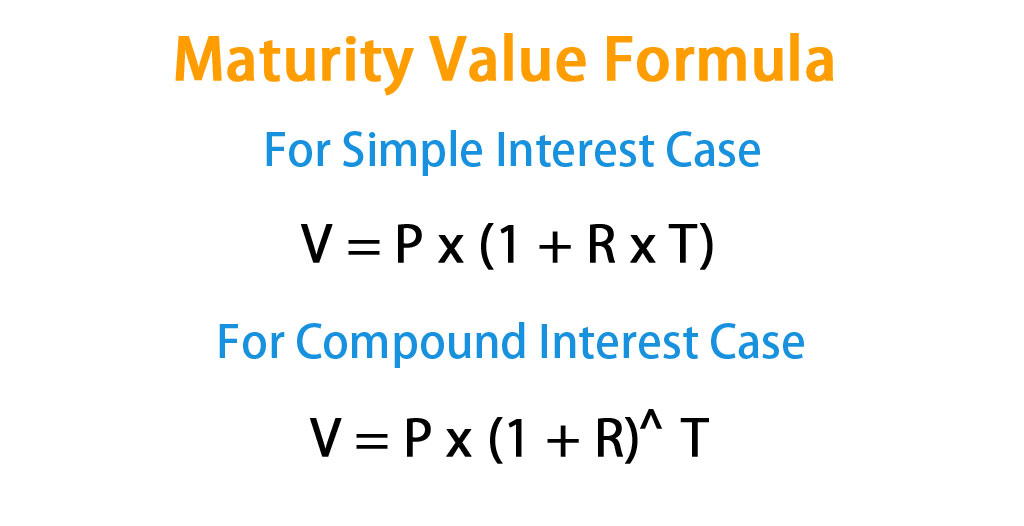

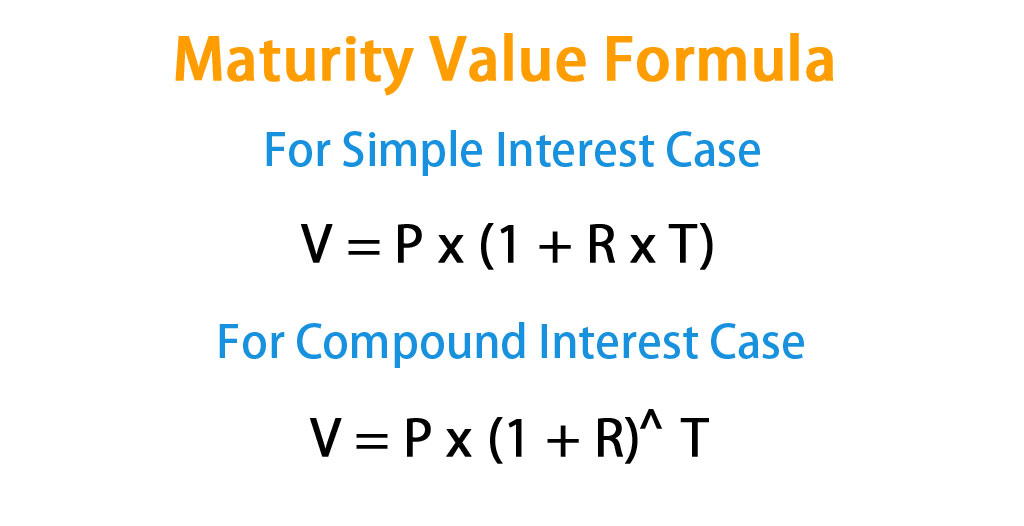

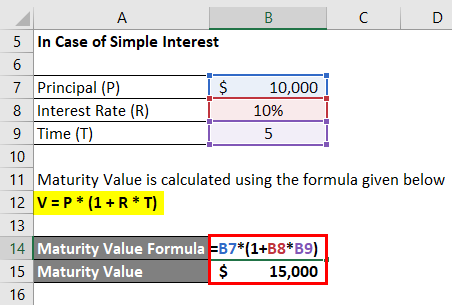

The maturity value formula is V P x 1 rn. Finally the formula for present value can be derived by discounting the future cash step 1 flow by using a discount rate step 2 and a number of years step 3 as shown below. Yield to maturity YTM is the total return anticipated on a bond if the bond is held until it matures.

About this item. One 1 311 lb. Purina senior dog food with MCT-rich vegetable oil to nourish and promote mental sharpness and showed an increased average activity level over 20 percent in dogs seven and older.

Maturity Value Formula Table of Contents Maturity Value Formula. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity. Chances are you will not arrive at the same value.

Plug the yield to maturity back into the formula to solve for P the price. V is the maturity value P is the original principal amount and n is the number of compounding intervals from the time of issue to maturity date. Annual Interest Payment Face Value - Current Price Years to Maturity Face Value Current Price 2 Lets solve that for the problem we pose by default in the calculator.

Read more is basically. Price per 100 FV. Bag - Purina ONE High Protein Senior Dry Dog Food Plus Vibrant Maturity Adult 7 Formula.

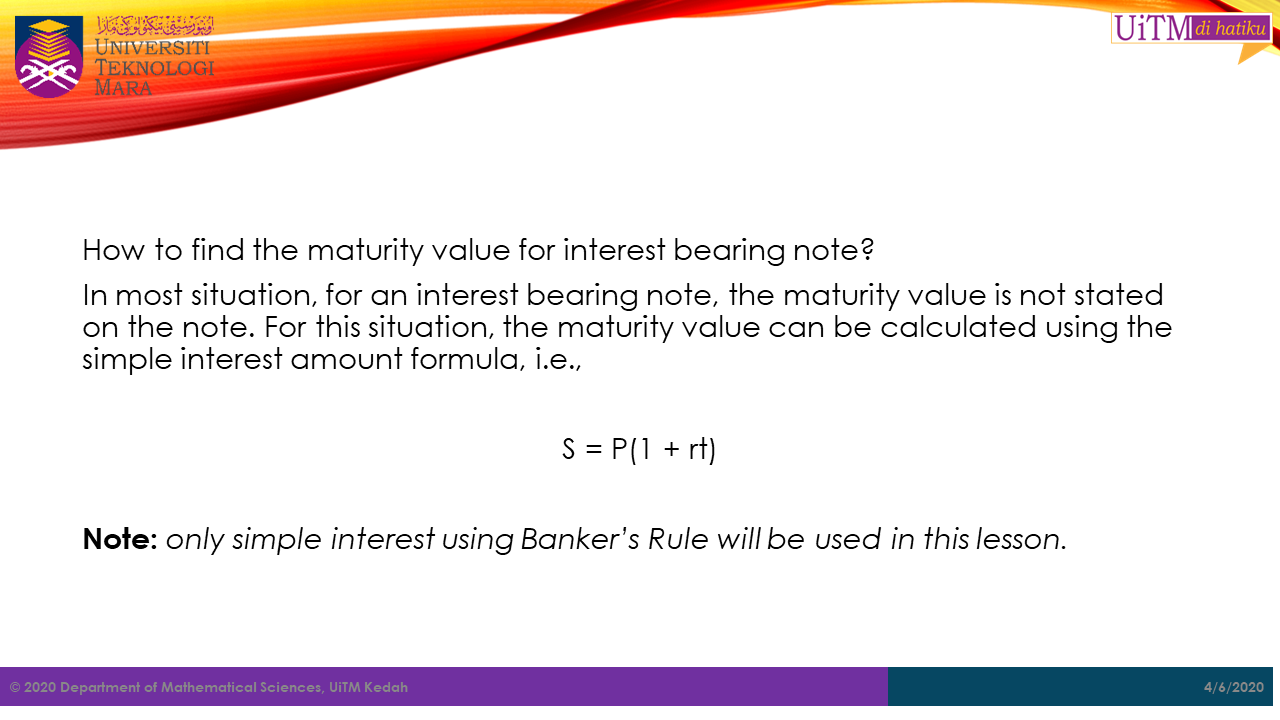

The formula for the approximate yield to maturity on a bond is. Formula to Calculate Bond Price. Maturity as its name suggests is the date on which the final payment for the financial instrument like a bond etc.

P the bond price C the coupon payment i the yield to maturity rate M the face value and n the total number of coupon payments. The variable r represents that periodic interest rate. You see that V P r and n are variables in the formula.

Happens and there is no more payment which a. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. Assume that there is a bond on the market priced at 850 and that the bond comes with a face value of 1000 a fairly common face value for bonds.

The formula for calculating the yield to maturity YTM is as follows. The maturity value formula is V P x 1 rn. The formula that is used for calculation of Maturity value involves the use of principal amount that is the amount which is invested at the initial period and n is the number of periods for which the investor is investing in and r is the rate of interest that is earned on that investment.

If you plug the 1125 percent YTM into the formula to solve for P the. Rather than compute compounding interest manually you can use a formula. The net present value of the cash flows of a bond added to the accrued interest provides the value of the Dirty Price.

Apply a formula to quickly calculate maturity value. Said differently the yield to maturity YTM on a bond is its internal rate of return IRR ie. You see that V P r and n are variables in the formula.

The discount rate which makes the present value PV of all the bonds future cash flows equal to its current market price. The formula for determining approximate YTM would look like below. Further if the number of compounding per year n is known then the formula for present value can be expressed as.

Examples of Maturity Value Formula With Excel Template Maturity Value Formula Calculator. PV CF 1 r t. The Accrued Interest Coupon Rate x elapsed days since last paid coupon.

To understand the uses of the function lets consider an example. On this bond yearly coupons are 150. As a worksheet function YIELD can be entered as part of a formula in a cell of a worksheet.

Maturity Value Formula Calculator Excel Template

Yield To Maturity Fixed Income

How Can I Calculate The Present Value Of A Bond Using Ytm Economics Stack Exchange

Zero Coupon Bond Formula And Calculator Excel Template

Zero Coupon Bond Value Formula With Calculator

Yield To Maturity Formula Ppt Video Online Download

Finding Maturity Value And Compound Interest Compounded Annually Number Sense 101 Youtube

Maturity Value Formula Calculator Excel Template

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id 2938012

Maturity Value Formula Calculator Excel Template

Maths For Recurring Deposits Financial Gyan

Solving For A Bond S Yield To Maturity With Semiannual Interest Payments Youtube

Yield To Maturity Ytm Formula And Calculator Excel Template

Maturity Value Formula Calculator Excel Template

Maturity Value Calculator Calculator Academy

Math Sc Uitm Kedah Bank Discount And Promissory Note

Javascript Need A Formula To Calculate Annually Compounded Recurring Deposits Stack Overflow